Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

Stamford Land Corporation Ltd (Stamford Land, previously known as Hai Sun Hup Group Ltd) commenced operations back in 1935, offering lighterage services (the transferring of cargo from ship to ship/dock). Its current major shareholder, Mr. Ow, joined the firm in 1962 and has been at the helm since 1966. In 1970, the firm expanded into shipping agencies/cargo terminal services and the company was listed on the SGX Mainboard in the 1980s. The foray into the hotel business began in 1994 when the firm acquired three hotels in Australia, Stamford Grand North Ryde, Stamford Grand Adelaide and Stamford Plaza Melbourne, and managed Sir Stamford Double Bay. A year later, Stamford Plaza Adelaide was acquired and in 1996, the firm secured Stamford Plaza Auckland and an undeveloped site in Perth (developed in 2010 into a Grade A office building called Dynon’s Plaza). In 1997, Stamford Land acquired Caltex House (Sydney), which was converted into a residential project (Stamford on Kent) in 2002. In 2000, the firm injected another three hotels (Stamford Plaza Brisbane, Sir Stamford at Circular Quay and Stamford Plaza Sydney Airport) into its portfolio, constructed Stamford Plaza Sydney, managed Stamford Plaza Double Bay and acquired Mann Judd Building (Sydney). The last was redeveloped into a residential project (Stamford Marque) in 2006 while Stamford Plaza Sydney was also converted into a residential project (187 Kent).

By 2001, the firm was involved in two distinctly different businesses and the team opted to demerge the shipping and logistics business (to a separate listed company called Singapore Shipping Corporation). The remaining entity was renamed to its present name to better reflect its hotel branding. At its peak, the firm managed ten hotels in Australasia. In 2004, the firm acquired a prime leasehold property at Gloucester Street (Sydney) and redeveloped it into a residential project (The Stamford Residences & Reynell Terraces). In 2009, the firm ceased managing Stamford Plaza Double Bay and a year later, Sir Stamford Double Bay was redeveloped into a residential project (The Stamford Cosmopolitan). In 2012, Stamford Grand North Ryde attained approval for redevelopment into a residential development with no less than 648 units. There were some adjustments to the layout of the project (named Macquarie Park Village) and the final design comprised 712 units across 7 towers, with gross sales close to A$500 mln. The hotel officially ceased operation in Jan 2015 and this project is slated for completion in 2018.

In 2013, the firm acquired freehold properties at Dulwich Hill, which were sold a year later after it secured development application approval. The Dulwich Hill asset was acquired for A$23.7 mln and sold for A$51 mln in less than 12 months. In 2014, Stamford Land lodged an application to redevelop the Sir Stamford at Circular Quay (prime location in Sydney) into a project with more than 100 residential units and more than 1,000 sqm of retail space. This redevelopment proposal is currently on hold as it has encountered several obstacles, especially with the owner of an adjacent building.

Business model – An exquisite Australasia hotelier and developer

Since its venture in 1994, Stamford Land has grown to be one of the largest independent owner-operators of luxury hotels in Australasia and has a reputation of developing high-end residential and commercial projects in the region. The firm’s key businesses include hotel operations and management, property development, property investment and trading business.

Under hotel operations, the firm has an enviable portfolio of well-located five star hotels. In Sydney, the firm owns the elegant Sir Stamford at Circular Quay, which is located along the historic Macquarie Street with proximity to the Royal Botanic Gardens and the Sydney Opera House, and offers a view of the city skyline. Another asset owned by the firm is the Stamford Plaza Sydney Hotel, which is located just minutes from the Sydney International Airport Terminal (opposite the Domestic Terminal) and caters to business and leisure travellers. This hotel is 15 minutes-drive from the CBD.

The redevelopment of Sir Stamford at Circular Quay may fetch redevelopment sales of around A$400 mln and generate returns of more than A$100 mln. (Source: www.stamford.com.au)

Stamford Grand Adelaide is one of the leading resort-style hotels in Australia and offers a panoramic view of the ocean. Located right on the beach, the resort is 10 minutes-drive from the airport and 20 minutes from Adelaide’s CBD. On the other hand, Stamford Plaza Adelaide is located right in the heart of Adelaide’s CBD and is a 15-minute drive from the airport. The hotel is located opposite the Adelaide Convention Centre, the Adelaide Casino and the Parliament House, and within walking distance of the Festival Centre, River Torrens, Adelaide's historic parklands, cinemas and boutique shopping.

The remaining three hotels, Stamford Plaza Melbourne, Stamford Plaza Brisbane and Stamford Plaza Auckland are all located in the heart of the respective cities’ CBD, and well-equipped with recreational facilities and easy access to the city’s shopping, theatre, restaurants and other venues – see table 1 for more information.

Assuming an average utilisation rate of 82%, Stamford Land hotel revenue per available room (Revpar) has ranged from about S$322 to S$388 (inclusive of certain F&B and conference spending) over the past six years. The rich Revpar exhibits the assets’ superiority and their pricing power. Stamford Land manages the hotel operation themselves, in a bid to lower income leakages that comes at the expense of the management’s time and effort. As is the case with many other operators, the team has to struggle with productivity issues amidst a high labour cost and excessive turnover environment.

Under the property development arm, Stamford Land is known for its luxury residential projects, including Stamford on Kent, 187 Kent, Stamford Marque, The Stamford Residences (Auckland), Stamford Cosmopolitan (Double Bay) and The Stamford Residences & Reynell Terraces. The firm still has a handful of unsold units in the last two projects. The current pipeline consists of Macquarie Park Village which is mostly sold and is likely to support sales for the next two financial years.

Under investment properties, Stamford Land owns Dynon’s Plaza which is fully leased to Chevron for 10 years with a net annual rental income of A$9.5 mln. The asset is currently valued at S$130 mln on the books, after a series of fair value write-downs (S$7.8 mln in FY2015, S$23.4 mln in FY2016, and S$11.5 mln in FY2017) due to conservative reasons. The one floor of office space in the Southpoint Building is valued at S$16.6 mln (around S$1,600 to S$1,700 psf). Lastly, the trading division consists of travel agency and interior decoration services – their contribution is minimal.

Industry – Mixed bag of influences

Australia’s tourism industry has been booming thanks to factors like a rising number of leisure (thanks to the rising Asian middle class) and business tourists (more Meetings, Incentives, Conferences, and Events) travellers, a weaker A$, cheaper airfares and others. Sydney is probably the best performing market with an average occupancy rate in the high 80s and a Revpar of more than A$200. This is mainly due to robust demand and a shortage of new hotels due to land space constraints. Frasers Hospitality REIT (SGX listed) has three hotels in Sydney and recorded an average occupancy rate of more than 90%. The occupancy rate in Melbourne is also healthy, slightly lower than that of Sydney, while cities like Perth, Brisbane and Adelaide are experiencing challenges (an average occupancy rate of 80% thereabout) due to a surge of supply in these areas.

On the residential front, demand for Australian residential projects has taken a breather recently following the decision to double stamp a duty surcharge (to 8%) on foreign property buyers in New South Wales. The restriction of currency outflow by China authorities also stifles sales and international agents are directing buyers to other destinations like the UK.

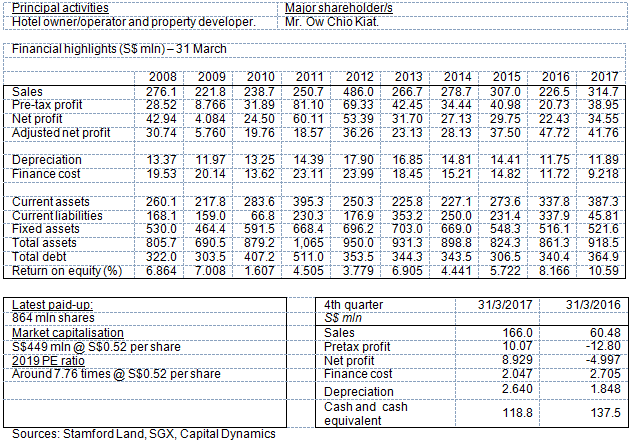

Financials – Stable performance and profitable since 2003

Stamford Land’s sales have averaged about S$287 mln over the past ten years, with hotel operations being the largest contributor, recording average sales of about S$210 mln. Sales from the property development segment fluctuated widely between S$14 mln and S$116 mln over the period. In FY2016, the figure was at a ten-year high due to the completion and settlement of 174 units in Macquarie Park Village. Contribution from the property investment segment was fairly stable at between S$12 mln and S$17 mln from FY2011 to FY2017. Operating expenses/sales ranged between 75% and 87% of sales, with staff cost averaging about 32% of sales over the past ten years. The firm has recorded a pretax margin of about 9.2% to 15.9% over the past ten years (after excluding the outliers). Stamford Land has been profitable since FY2003 – the loss in FY2002 was due to a change in accounting treatment for warrants, a tough operating environment and an one-off impairment losses following the Sep 2001 incident. The performance in FY2009 was weak due to a weaker A$, marketing expenses for property development projects and impairment losses on short-term investments. Though the firm has recorded impairment losses on Dynon’s Plaza over the past three years, FY2015 results were supported by a one-off Dulwich Hill divestment while FY2017 results were boosted by sales in Macquarie Park Village. Dividends per share averaged about 3 cents annually between FY2010 and FY2015, and fell to 0.5 cents in FY2016 and 1 cent in FY2017. The management has been trying to conserve cash lately for expansion plans.

Stamford Land’s balance sheet has remained largely unchanged since FY2008, with gearing averaging between S$300 mln and S$400 mln over the past ten years. The redevelopment of Macquarie Village Park led to a corresponding spike in development properties for sale but was offset by a decline in investment properties and PPE. Asset turnover has averaged at 0.33 times over the past ten years, while leverage averaged at 1.89 times.

Conclusion

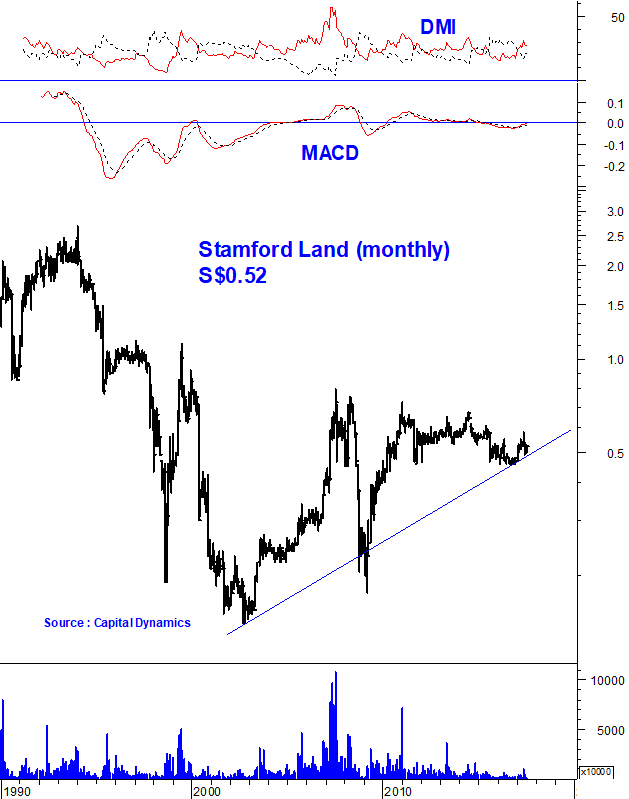

At a price of S$0.52 per share, Stamford Land Corporation Ltd is capitalised at S$449 mln. What do investors get in return for this ?

With its portfolio of quality assets, Stamford Land offers a unique exposure to the Australasia hotel and tourism sector. The management team has also demonstrated its value-picking caliber over the years in its seizing of assets at cheap valuation prior to 2000, its redevelopment of Dynon’s Plaza, its recent purchase and sale of the Dulwich Hill asset and others.

More importantly, only assets in the investment properties segment, i.e. Dynon’s Plaza and the floor space in Southpoint Building, are recorded at market valuation. The former is valued at around S$130 mln (7% cap rate), the latter at S$16.6 mln (excluding owner occupied floor space). The adjusted valuation of the floor space in Southpoint Building should be around S$27 mln assuming a total floor space of 18,000 sqft at S$1,500 psf.

The firm sees the hotel assets as PPE, since it owns and manages them, and they are recorded at acquisition costs less depreciation. The acquisition cost of the seven hotels is slightly more than A$400 mln and they are valued at around S$329 mln as of FY2017 – the lower figure is due to depreciation on the buildings and leasehold land.

Frasers Hospitality Trust recently acquired Novotel Melbourne on Collins (380 rooms) for A$237 mln, suggesting an average room rate of A$624K per room. In another instance, the Pan Pacific Hotels Group acquired Hilton Melbourne South Wharf (396 rooms) for A$230 mln, suggesting an average room rate of A$581K per room. It is tough to put an exact valuation on Stamford Land hotels considering how some of them have redevelopment potential. For example, the redevelopment of Sir Stamford at Circular Quay may fetch redevelopment sales of around A$400 mln and generate returns of more than A$100 mln. Stamford Grand North Ryde (previously a 4.5 star hotel with 257 rooms) is projected to rope in more than A$150 mln profit for the group.

Stamford Land’s seven hotels have an aggregate of 1,796 rooms; assuming a valuation of A$550K per room, the hotels are worth about S$1.04 bln (assuming A$1 to S$1.05). The company still has another S$220 mln in proceeds from its development properties, a cash and cash equivalent of about S$119 mln, S$18 mln from completed properties for sale, and proceeds from the unsold units at Macquarie Park Village, which should be sufficient to offset its S$365 mln borrowings. As such, the adjusted net asset value of Stamford Land is approximately S$1.19 bln (after including the investment properties), or S$1.38 per share. Hotel operations alone have generated an EBIT of more than S$30 mln annually over the past ten years, suggesting base earnings per share of about 3.4 cents. Contributions from the property development segment are likely to be robust over the next two years.

The deciding factor for Stamford Land lies in how the management is going to unlock the value within its assets and growth plans. The assets may be formed into a REIT (provided there is usage for the capital raised), while at the operating level, the team may venture into a second tier hotel brand or provide management services with equity participation in other projects. For now, the firm trades at an adjusted P/RNAV of about 0.38 times. In all, i Capital rates Stamford Land Corporation Ltd a Buy over the longer term.

Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

Capital Dynamics Sdn Bhd and Capital Dynamics Asset Management Sdn Bhd, being capital market intermediaries licensed by the Securities Commission of Malaysia, are operating as usual in accordance with the Standard Operating Procedures prescribed by the relevant authorities. We will continue to take precautionary measures to protect our employees, clients and other stakeholders. You may reach us at +603-2070 2104 or 2105 or 2106 or email us at cdsb@icapital.biz (investment advisory) or enquiries@cdam.biz (asset management) for any enquiries.

Note from Publisher

Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

Announcement

Capital Dynamics Sdn Bhd and Capital Dynamics Asset Management Sdn Bhd, being capital market intermediaries licensed by the Securities Commission of Malaysia, are operating as usual in accordance with the Standard Operating Procedures prescribed by the relevant authorities. We will continue to take precautionary measures to protect our employees, clients and other stakeholders. You may reach us at +603-2070 2104 or 2105 or 2106 or email us at cdsb@icapital.biz (investment advisory) or enquiries@cdam.biz (asset management) for any enquiries.

Covid-19 SOP

All Capital Dynamics offices are operating as usual in accordance with the requirements/standard operating procedures ("SOP") as prescribed by the relevant authorities in their respective countries......MoreCovid-19 SOP

All Capital Dynamics offices are operating as usual in accordance with the requirements/standard operating procedures ("SOP") as prescribed by the relevant authorities in their respective countries.We will continue to take precautionary measures to protect our employees, clients and other stakeholders. All visitors must wear face masks and ensure social distancing when you visit any of our offices. To better manage your visits and avoid any inconvenience, you are advised to make an appointment with us before your visit via phone call or via email to the relevant offices. For more details, please access the webpage of the relevant offices.Less

Impersonation

Dear clients, followers and friends,

We would like to alert you to ongoing impersonation scams, with fraudsters posing as employees, financial advisors, representatives, agents and/or associates of the Capital Dynamics Group by using pseudonyms.....MoreImpersonation

Dear clients, followers and friends,

We would like to alert you to ongoing impersonation scams, with fraudsters posing as employees, financial advisors, representatives, agents and/or associates of the Capital Dynamics Group by using pseudonyms. There have also been instances where fraudsters impersonated Mr Tan Teng Boo (“Mr Tan”), the Managing Director and representative of Capital Dynamics Group which comprises Capital Dynamics Asset Management Sdn Bhd, Capital Dynamics Sdn Bhd, Capital Dynamics Global Pte Ltd, Capital Dynamics (S) Pte Ltd, Capital Dynamics Asset Management (HK) Pte Ltd, Capital Dynamics (Australia) Ltd and Capital Dynamics Investment Management and Advisory (Shanghai) Co Ltd.. These fraudsters / impersonators have created fake social media accounts / profiles and/or online applications to carry out their impersonation scams.

Based on information received to date, the modus operandi of the impersonation scams appears to be:

- The fraudsters would reach out to the public via SMS text messages, WhatsApp, Telegram, LINE or Facebook. They may claim to be financial advisors from the Capital Dynamics Group and present fake licences and/or certificates purportedly issued by financial regulators to advise on investments and/or carry out investment plans.

- At times, they may also claim to be Mr Tan by using fake Facebook / WhatsApp profiles and groups which display Mr Tan’s name and photos. The fake WhatsApp profile appears to be created using the mobile number +60111492189. There may be other fake WhatsApp profiles created by the fraudsters. These fake profiles are not managed by the Capital Dynamics Group and/or its employees including Mr Tan.

- By impersonating our employees and/or claiming to be financial advisors acting on behalf of Capital Dynamics Group, the fraudsters would deceive victims into opening “accounts” with certain “trading platforms”. The fraudsters would falsely claim that they would guide the victims to conduct trades with immediate gains, or that they were offering investment plans or training courses purportedly on behalf of the Capital Dynamics Group. Consequently, the victims were induced to transfer money or cryptocurrency to their “trading accounts”. Over time, the victims were not able to withdraw their money or cryptocurrency and the fraudsters became uncontactable.

We urge all of you to exercise caution and to conduct the necessary due diligence before making any investments. Kindly note that:

- We will never ask our clients to open accounts with trading platforms and to transfer money or cryptocurrency to these accounts. We are not affiliated or linked in any way to these illicit and unlicensed “trading platforms”.

- We do not offer investment advice, investment plans or training courses through agents.

- Any information on our fund management services (as well as our investment advice, opinion and events) is published only on our official websites, iCapital publications and/or official social media accounts. A list of our official channels may be found below.

- You should lodge police reports if you think that you may be a victim of scams.

- Please contact us if you have any doubts or uncertainties over any communications made to you by any person claiming to be an employee, officer, financial advisor, representative, agent and/or anyone claiming to be associated with the Capital Dynamics Group. The contact details of each of our offices may be found at this link: https://www.capitaldynamics.biz/en.

The scams were conducted without the knowledge, consent and authority of Capital Dynamics Group and our management. We as well as our Managing Director have lodged police reports in Kuala Lumpur and Singapore and have duly notified the authorities of these impersonations and scams.

More information on the impersonation scams may be found at: https://www.icapital.biz/public/general_announcements

Best wishes,

Capital Dynamics Group Less

Copyright © 2002 - Capital Dynamics Sdn Bhd (Co. No. 171744-U). All rights reserved.

i Capital ® and Capital Dynamics ® are registered trademarks of Capital Dynamics Sdn. Bhd.