Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

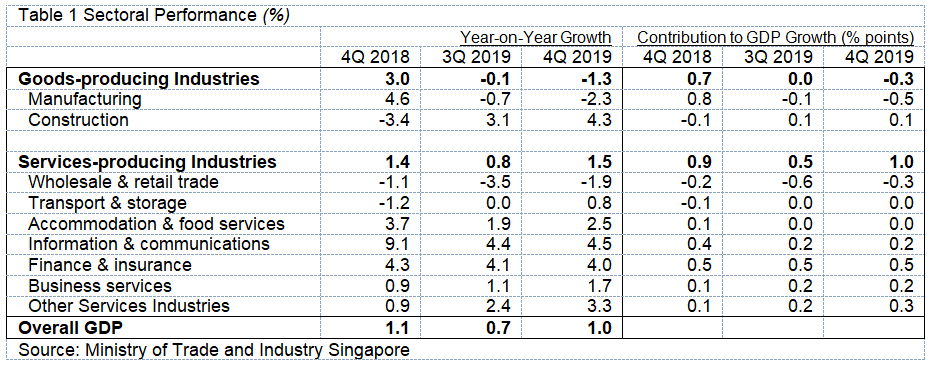

In 4Q 2019, Singapore’s economy grew by 1.0%, year-on-year, improving slightly from the 0.7% expansion in the previous quarter – see table 1. The finance & insurance, other services industries and business services sectors were the largest contributors to GDP growth. On a quarter-on-quarter seasonally-adjusted annualised basis, Singapore’s economy expanded by 0.6%, which is a decline from the 2.2% growth in the preceding quarter. For the whole of 2019, Singapore’s economy grew by 0.7% on a year-on-year basis.

In 2019, the contraction in output from the goods-producing industries (-0.8%) was attributed to a contraction in the manufacturing sector (-1.4%). The fall was mainly driven by declines in output in the electronics, chemicals, precision engineering and transport engineering clusters. On the other hand, the construction sector increased 2.8% due to growth in both public and private sector construction activities.

The services-producing industries continued to expand (1.1%), albeit at a slower pace. The information & communications sector recorded the highest growth rate (4.3%), followed by the finance & insurance sector (4.1%).

Demand Conditions

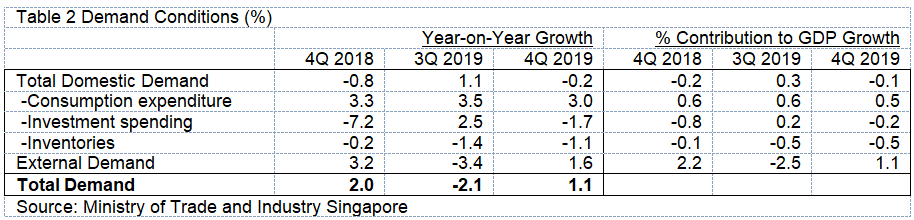

In 4Q 2019, total demand rose by 1.1%, year-on-year, reversing the 2.1% decline in 3Q 2019. Domestic demand declined slightly while external demand recovered – see table 2. For the whole of 2019, total demand fell by 0.7%, a sharp decline compared with the 6.3% growth recorded in 2018.

Labour Market and Productivity

In 4Q 2019, total employment increased by 18,300, quarter-on-quarter, smaller than the increase of 26,000 in 3Q 2019, but it was higher than the increase of 15,900 in 4Q 2018. Employment growth was driven by increases in employment for all sectors, with the services sector registering a gain of 13,000, construction up by 4,600, and manufacturing up by 700.

Year-on-year, labour productivity fell by 1.6% in 4Q 2019, larger than the 0.9% fall in 3Q 2019. Productivity of outward-oriented and domestic-oriented sectors respectively fell by 2.3% and 0.6%. For the whole of 2019, labour productivity decreased by 1.5%, a reversal from the 3.9% growth in 2018. By sector, only the construction and finance & insurance sectors experienced growth, while all other sectors suffered a decline in productivity

Balance of Payments

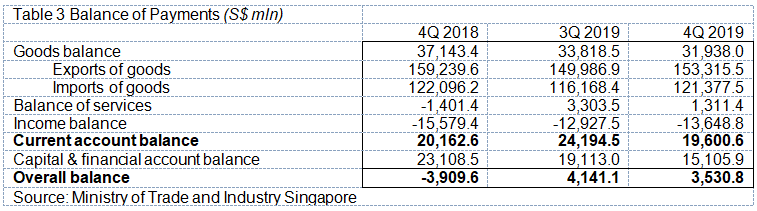

Singapore recorded a balance of payments deficit of S$11.4 bln in 2019, declining from the surplus of S$16.9 bln in 2018. This was due to a larger net outflow from the capital and financial account which outweighed the current account surplus. In 4Q 2019, the balance of payments recorded a surplus of S$3.5 bln, which narrowed from the surplus of S$4.1 bln in 3Q 2019 – see table 3.

Price, Interest, and Exchange Rates

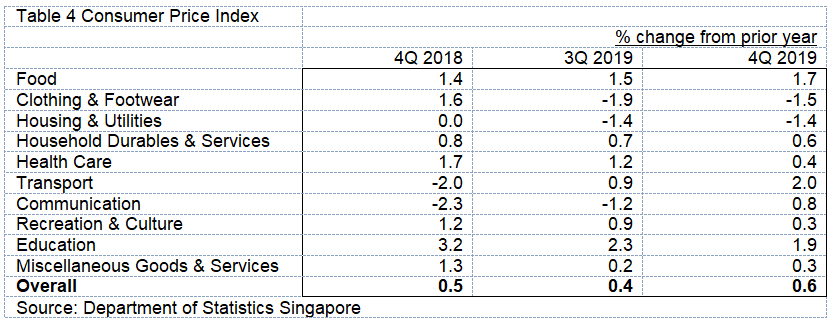

Year-on-year, the consumer price index (CPI) increased by 0.6% in 4Q 2019, up from the increase of 0.4% in the previous quarter – see table 4. For the whole of 2019, the CPI rose by 0.6% with the largest contributor to inflation being the food category.

At the end of 4Q 2019, the prime lending rate declined to 5.25%, from 5.33% in the same period a year ago. In terms of the average interest rates quoted by the 10 leading banks, the 12-month fixed deposit rate rose by 0.12 percentage points to 0.57%, while the savings deposit rate remained unchanged at 0.16%.

In the foreign exchange market, at the end of 4Q 2019 the Singapore Dollar appreciated against the Euro, US Dollar, Australian Dollar, Chinese Renminbi, Hong Kong Dollar and Malaysian Ringgit by 3.5%, 1.3%, 2.1%, 2.7%, 0.7% and 0.2% respectively compared with a year ago. On the other hand, it depreciated against the British Pound and the Japanese Yen by 2.1% and 0.3% respectively.

Comments

Although Singapore’s economic growth improved slightly in 4Q 2019, it is expected to be subdued in 2020. The COVID-19 has disrupted global supply chains, discouraged international trade and tourism. While the US-China trade war may have reached a truce, it could flare up anytime, depending on the mood of US politicians. Besides that, many global risks remained unresolved, including Brexit and recessionary risk in a low interest rate environment. Singapore, being a small open economy, is extremely vulnerable to the adverse global developments, especially when it involves China, the biggest contributor to world economic growth and Singapore’s largest export market and tourist generating country.

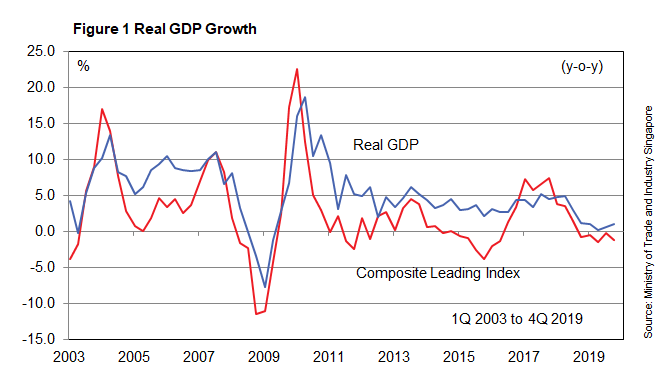

Reflecting the dire conditions, the composite leading index (CLI) fell 1.2%, year-on-year, in 4Q 2019 – see figure 1. The CLI has been declining since 4Q 2018. As a result, i Capital expects Singapore’s real GDP to fall in the range of 0.2% – 1.3%, year-on-year, in 1Q 2020. For the whole of 2019, economic growth is expected to be in the range of -1.2% – 0.5%.

Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

Capital Dynamics Sdn Bhd and Capital Dynamics Asset Management Sdn Bhd, being capital market intermediaries licensed by the Securities Commission of Malaysia, are operating as usual in accordance with the Standard Operating Procedures prescribed by the relevant authorities. We will continue to take precautionary measures to protect our employees, clients and other stakeholders. You may reach us at +603-2070 2104 or 2105 or 2106 or email us at cdsb@icapital.biz (investment advisory) or enquiries@cdam.biz (asset management) for any enquiries.

Note from Publisher

Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

Announcement

Capital Dynamics Sdn Bhd and Capital Dynamics Asset Management Sdn Bhd, being capital market intermediaries licensed by the Securities Commission of Malaysia, are operating as usual in accordance with the Standard Operating Procedures prescribed by the relevant authorities. We will continue to take precautionary measures to protect our employees, clients and other stakeholders. You may reach us at +603-2070 2104 or 2105 or 2106 or email us at cdsb@icapital.biz (investment advisory) or enquiries@cdam.biz (asset management) for any enquiries.

Covid-19 SOP

All Capital Dynamics offices are operating as usual in accordance with the requirements/standard operating procedures ("SOP") as prescribed by the relevant authorities in their respective countries......MoreCovid-19 SOP

All Capital Dynamics offices are operating as usual in accordance with the requirements/standard operating procedures ("SOP") as prescribed by the relevant authorities in their respective countries.We will continue to take precautionary measures to protect our employees, clients and other stakeholders. All visitors must wear face masks and ensure social distancing when you visit any of our offices. To better manage your visits and avoid any inconvenience, you are advised to make an appointment with us before your visit via phone call or via email to the relevant offices. For more details, please access the webpage of the relevant offices.Less

Impersonation

Dear clients, followers and friends,

We would like to alert you to ongoing impersonation scams, with fraudsters posing as employees, financial advisors, representatives, agents and/or associates of the Capital Dynamics Group by using pseudonyms.....MoreImpersonation

Dear clients, followers and friends,

We would like to alert you to ongoing impersonation scams, with fraudsters posing as employees, financial advisors, representatives, agents and/or associates of the Capital Dynamics Group by using pseudonyms. There have also been instances where fraudsters impersonated Mr Tan Teng Boo (“Mr Tan”), the Managing Director and representative of Capital Dynamics Group which comprises Capital Dynamics Asset Management Sdn Bhd, Capital Dynamics Sdn Bhd, Capital Dynamics Global Pte Ltd, Capital Dynamics (S) Pte Ltd, Capital Dynamics Asset Management (HK) Pte Ltd, Capital Dynamics (Australia) Ltd and Capital Dynamics Investment Management and Advisory (Shanghai) Co Ltd.. These fraudsters / impersonators have created fake social media accounts / profiles and/or online applications to carry out their impersonation scams.

Based on information received to date, the modus operandi of the impersonation scams appears to be:

- The fraudsters would reach out to the public via SMS text messages, WhatsApp, Telegram, LINE or Facebook. They may claim to be financial advisors from the Capital Dynamics Group and present fake licences and/or certificates purportedly issued by financial regulators to advise on investments and/or carry out investment plans.

- At times, they may also claim to be Mr Tan by using fake Facebook / WhatsApp profiles and groups which display Mr Tan’s name and photos. The fake WhatsApp profile appears to be created using the mobile number +60111492189. There may be other fake WhatsApp profiles created by the fraudsters. These fake profiles are not managed by the Capital Dynamics Group and/or its employees including Mr Tan.

- By impersonating our employees and/or claiming to be financial advisors acting on behalf of Capital Dynamics Group, the fraudsters would deceive victims into opening “accounts” with certain “trading platforms”. The fraudsters would falsely claim that they would guide the victims to conduct trades with immediate gains, or that they were offering investment plans or training courses purportedly on behalf of the Capital Dynamics Group. Consequently, the victims were induced to transfer money or cryptocurrency to their “trading accounts”. Over time, the victims were not able to withdraw their money or cryptocurrency and the fraudsters became uncontactable.

We urge all of you to exercise caution and to conduct the necessary due diligence before making any investments. Kindly note that:

- We will never ask our clients to open accounts with trading platforms and to transfer money or cryptocurrency to these accounts. We are not affiliated or linked in any way to these illicit and unlicensed “trading platforms”.

- We do not offer investment advice, investment plans or training courses through agents.

- Any information on our fund management services (as well as our investment advice, opinion and events) is published only on our official websites, iCapital publications and/or official social media accounts. A list of our official channels may be found below.

- You should lodge police reports if you think that you may be a victim of scams.

- Please contact us if you have any doubts or uncertainties over any communications made to you by any person claiming to be an employee, officer, financial advisor, representative, agent and/or anyone claiming to be associated with the Capital Dynamics Group. The contact details of each of our offices may be found at this link: https://www.capitaldynamics.biz/en.

The scams were conducted without the knowledge, consent and authority of Capital Dynamics Group and our management. We as well as our Managing Director have lodged police reports in Kuala Lumpur and Singapore and have duly notified the authorities of these impersonations and scams.

More information on the impersonation scams may be found at: https://www.icapital.biz/public/general_announcements

Best wishes,

Capital Dynamics Group Less

Copyright © 2002 - Capital Dynamics Sdn Bhd (Co. No. 171744-U). All rights reserved.

i Capital ® and Capital Dynamics ® are registered trademarks of Capital Dynamics Sdn. Bhd.