Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

The Covid-19 pandemic has turned the world upside down in ways that none of us could have ever imagined. For example, the restaurant/eatery business was often touted as a safe, recession-proof business to venture into. The reasoning was simple. Even in a recession, one still needs to eat, right ? The pandemic has proven this aphorism wrong.

In another example, Genting used to be a favourite stock among investors. Its addictive casino business, which investors perceived as an all-season, recession-proof business, made Genting a safe investment. Like the restaurant/eatery business, the Covid-19 pandemic has turned its normally resilient business upside down. What else is new ?

"This pandemic has also created a new category of shares for the KLSE. We call them the “right angle stocks”."

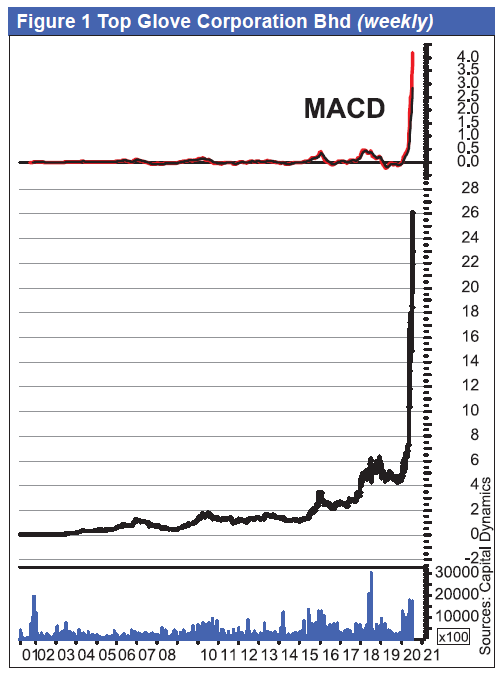

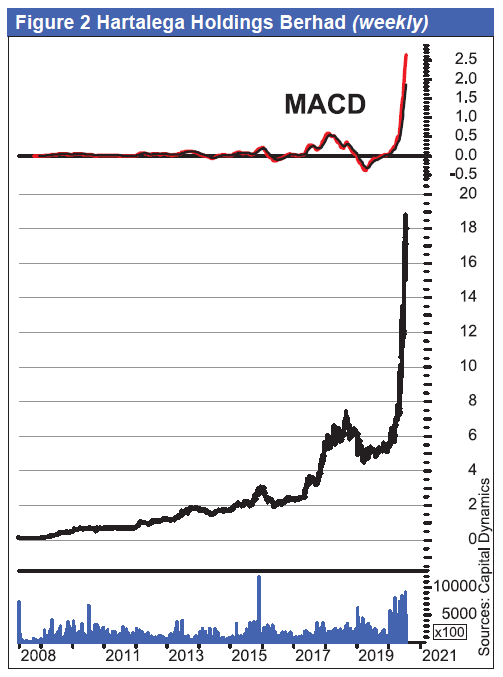

This pandemic has also created a new category of shares for the KLSE. We call them the “right angle stocks”. The best examples of this new class of stocks are Top Glove (figure 1) and Hartalega (figure 2). The charts of these 2 top performing stocks are self-explanatory – they are right-angled. After being flattish for a prolonged period, their share prices have surged in an almost vertical fashion within a short period of only around 4 months. Can this last ?

From 19 Mar 2020 to 22 Jul 2020, the share price of Top Glove has surged 4.44 times while that of Hartalega by 2.75 times. From 19 Mar, the lowest point reached by the KLCI in the Covid-19 crash, to 22 Jul 2020, the market capitalisation of Top Glove has jumped from RM14.99 bln to RM66.59 bln. For Hartalega, its market capitalisation has surged from RM21.41 bln to RM58.88 bln.

At that rate of increase, Top Glove would be capitalised at RM296 bln and Hartalega at RM162 bln some time in Nov 2020. The total market valuation of these 2 stocks then would be RM458 bln or at an exchange rate of RM4.30 to a US$, equivalent to US$106.5 bln. How big is this ? In 2019, Malaysia’s GDP was worth US$365 bln. So, these 2 Malaysian glove stocks would be equivalent to about 30% of Malaysia’s entire economy. Fast growing technology giant Amazon.com, with a market capitalisation of US$1.54 trillion as at 22 Jul 2020, is only equivalent to 7% of the 2019 US GDP.

Well, some may say that there is a shortage of gloves and the pandemic is still far from over, so the 2 rubber glove stocks would still have a long way to climb. Assuming the same rate of rise again, Top Glove would be capitalised at RM1.302 trillion and Hartalega at RM446 bln some time in Mar 2021. The total market valuation of these 2 Malaysian glove stocks would then be RM1.748 trillion or at an exchange rate of RM4.30 to a US$, equivalent to US$406.5 bln. How big is this ? The 2 stocks will be bigger than the entire Malaysian economy. Imagine the market capitalisation of fast growing Amazon.com is bigger than the entire US economy.

"In 2019, Malaysia’s GDP was worth US$365 bln. So, these 2 Malaysian glove stocks would be equivalent to about 30% of Malaysia’s entire economy. Fast growing technology giant Amazon.com, with a market capitalisation of US$1.54 trillion as at 22 Jul 2020, is only equivalent to 7% of the 2019 US GDP."

On 19 Mar 2020, the 2 rubber glove stocks made up 4.6% of the KLCI market valuation. 4 months later, they make up 12.3% of the KLCI market valuation. On 22 Jul 2020, only Maybank and Public Bank have bigger market capitalisation than Top Glove. Even Tenaga Nasional, ranked 4th, was smaller than Top Glove. Hartalega was ranked 5th. By Nov 2020, the market capitalisation of Top Glove could be a few times larger than that of Maybank.

From 19 Mar 2020 to 22 Jul 2020, the KLCI has jumped 30% from 1,219 points to 1,586 points. On the surface, this looks pretty impressive. A closer look would however show that 41.4% of this rise actually came from the said 2 rubber glove stocks. Had the share prices of the said two stocks on 22 Jul 2020 remained the same as in 19 Mar 2020, the KLCI would have only risen to 1,434 points or 152 points lower than what it actually was.

What is i Capital trying to say with all these obervations ? While the Covid-19 pandemic has created the “right angle stocks” that take off vertically, investors should make sure their feet are solidly on the ground. The annualised earnings per share of Top Glove for FY2020 are 30 sen. At a closing price of RM26.12 on 23 July 2020, Top Glove’s PE multiple is 87 times. Is this low or high ? It all depends on one’s forecast. In the past 8 years, its PE ratio has ranged from 14 to 38 times. At a PE ratio of 38 times, its FY2021 earnings per share would have to be 56.9 sen. At a PE ratio of 14 times, Top Glove’s FY2021 earnings per share would have to be 186.6 sen. Which forecasted earnings figure will be reached is anyone’s guess; even the top management of the glove companies would not know. Many years ago, Tan Teng Boo would remind subscribers of i Capital that forecasts are forecasts and they are not realities. Very often, realities would turn out to be very different from forecasts. In i Capital dated 21 May 2020, it advised that when too many people are too pessimistic, it is time to be optimistic. Tan Teng Boo advised : “Based on our experience, whenever everyone gets optimistic, it is time be fearful. Similarly, whenever everyone gets too pessimistic, as the situation seems to be now, it is time to be ready for the opposite”. The same applies when the opposite occurs. That is, when the majority is optimistic, it is time to be cautious.

"Had the share prices of the said two stocks on 22 Jul 2020 remained the same as in 19 Mar 2020, the KLCI would have only risen to 1,434 points or 152 points lower than what it actually was."

Forecasts are forecasts. No one could have predicted the outbreak of the Covid-19 pandemic and similarly when the pandemic will peak in the US, Brazil, India, etc. In the same manner, no one can predict when the vaccine or vaccines for SARS-CoV-2 will be successfully launched. There are already a number of pharmaceutical companies from China, the US, the UK, etc that have announced promising results. Most importantly, what subscribers of i Capital need to remember is that the underlying business model of the glove companies is that of a commodity business. When there is a shortage, such a business will boom. When there is a glut, the business will suffer. The same goes for crude palm oil or crude oil or rubber or copper or any other commodity business. It is all a question of demand and supply. When disequilibrium occurs, changes in demand and/or supply will quickly swing the disequilibrium to the opposite side. In commodities like crude oil or rubber or copper, production capacity and hence supply data of that commodity is transparent and available to all. This is not the case for glove production, especially data pertaining to planned or actual expansion in glove production capacity by existing players or the entry of new glove makers. The barriers of entry to the glove business are not high and with the business seemingly enjoying good times forever, how can this not attract new glove makers ?

"Many years ago, Tan Teng Boo would remind subscribers of i Capital that forecasts are forecasts and they are not realities."

Most analysts or fund managers would not be familiar with a similar boom and bust cycle for glove companies in the Nineteen Eighties. Only veteran unique ones like Tan Teng Boo would be familiar. i Capital has previously written about AIDS. To quote from the same 21 May 2020 issue, i Capital wrote:

“The human immunodeficiency virus (HIV) or AIDS is also a virus, one that attacks the immune system. To show the fear about the HIV pandemic, we quoted from 1987 :

- Some 20 District of Columbia police officers raided a homosexual social club wearing gloves, face masks and bulletproof vests to "protect themselves from a lethal threat."

- A British AIDS victim who died of the disease has been entombed in concrete at a cemetery in North Yorkshire as a precaution "in case we ever opened up the coffin again," explained a spokesman for the county's health department.

- The director of a Chicago AIDS clinic and information hotline reports a phone call from a worried motorist who had run over a pedestrian he believed to be gay. The motorist wanted to know how to decontaminate his car, which had die [sic] man's blood on it.”

"Most importantly, what subscribers of i Capital need to remember is that the underlying business model of the glove companies is that of a commodity business. When there is a shortage, such a business will boom. When there is a glut, the business will suffer."

Globally, there were widespread fears about AIDS/HIV back in the Nineteen Eighties. One consequence of this was a sudden boost in global demand for rubber gloves, just like now. At that time, the Malaysian glove players were not listed companies. Nevertheless, the surge in demand led to a global mushrooming of glove makers. They came from all corners of the world. Well, like every commodity boom, this unnoticed surge in supply soon led to a plunge in glove prices. Before we know it, many of the glove makers were bankrupt and many others exited the industry. There is still no vaccine for HIV after 40 years. With the surge in the share prices of Top Glove, Hartalega, etc, we are now in a similar commodity boom. We do not know when the bust will come even though it will surely happen eventually, just like day will follow night. When the bust happens, do make sure you are not the one caught holding the unwanted baby because when the bust comes, it will catch most people by surprise. Again.

"Globally, there were widespread fears about AIDS/HIV back in the Nineteen Eighties. One consequence of this was a sudden boost in global demand for rubber gloves, just like now."

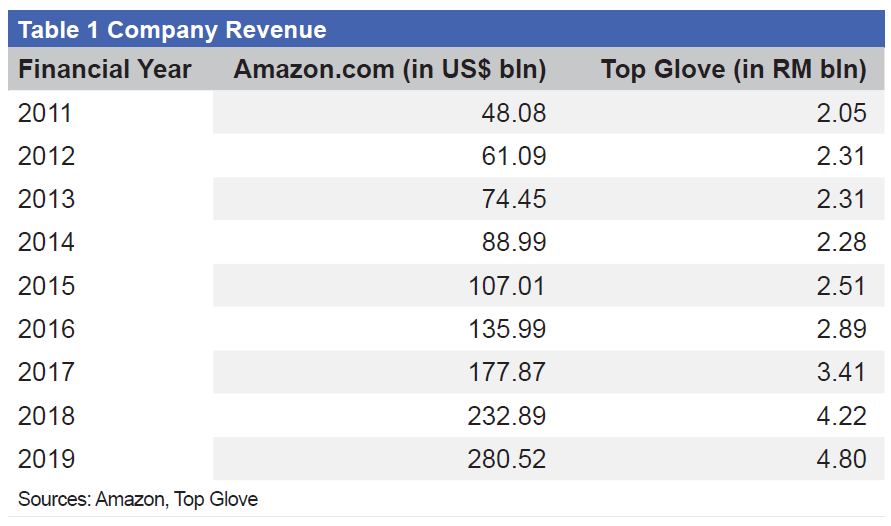

What happened to the glove players in the Nineteen Eighties will happen again, despite the current scary Covid-19 pandemic. Amazon.com revenue surged from US$48 bln in FY2011 to US$281 bln in FY2019 or a jump of 485% (table 1). During the same period, Top Glove’s revenue rose from RM2.05 bln in FY2011 to RM4.80 bln in FY2019 or just a gain of only 134%.

In the last 6 years, Amazon’s earnings per share went from a negative US$0.52 to a positive US$23.10. In comparison, Top Glove’s growth in earnings per share in the same period has been a crawl. What is most important, however, is not the growth rate but the fact that the business model of the 2 companies is fundamentally very different. One is powered by a long lasting technology-driven disruption, while the other is still a traditional cyclical boom and bust commodity business. No one knew when the boom was coming; few will know when the bust has arrived. As always, make sure there is sufficient margin of safety. There are no good reasons why the share prices of the glove stocks would not go back to where they came from. 1,000 shares of Top Glove can buy more than 37,000 shares of AirAsia. One is priced at 87 times PE multiple and the other is priced as if the airline industry will go extinct. Hmm, where is the margin of safety ?

"There are no good reasons why the share prices of the glove stocks would not go back to where they came from. 1,000 shares of Top Glove can buy more than 37,000 shares of AirAsia."

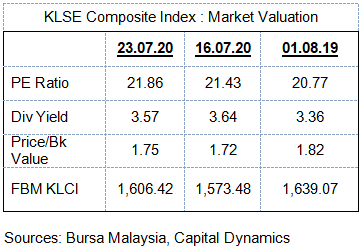

THE KLSE

As explained above, the KLCI would have been 10% lower had a few glove stocks not surged vertically. Such a rise is not sustainable at all. Only an independent, objective and socially responsible investment adviser like i Capital would tell you so. For now, i Capital revises slightly its immediate-term outlook of the KLCI to a range of 1,400 to 1,610. The KLCI is very ripe for a sharp correction, led by the “right-angled stocks” of i Capital. i Capital retains its short-term outlook of the KLCI at a range of 1,300 to 1,600.

i Capital is also retaining its long-term outlook of the KLSE as highly uncertain. Its long-term outlook will be dependent on what happens to Malaysia in the medium-term. We have in the past written that, in the medium term, a lot will depend on Malaysia’s shaky political environment. Going the wrong way will make the bearish medium-term outlook of i Capital with a target of 700/800 come true. In the medium-term, there will be another general election. Should Malaysians wisely stop listening to the power crazy politicians and discover national interest, embrace wisdom and focus on the longer-term, maybe Malaysia would be able to have a much improved government, one that can concentrate on tackling the many longer-term structural problems. In such a delighted event, the bearish medium-term outlook of i Capital will be revised to bullish with possible targets of 2,000 plus for the KLCI. Nevertheless, it is useful to remember that the day when the ruling party or parties in Malaysia can command a two-third majority in the Lower House of Parliament is as remote as discovering a red diamond.

Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

Capital Dynamics Sdn Bhd and Capital Dynamics Asset Management Sdn Bhd, being capital market intermediaries licensed by the Securities Commission of Malaysia, are operating as usual in accordance with the Standard Operating Procedures prescribed by the relevant authorities. We will continue to take precautionary measures to protect our employees, clients and other stakeholders. You may reach us at +603-2070 2104 or 2105 or 2106 or email us at cdsb@icapital.biz (investment advisory) or enquiries@cdam.biz (asset management) for any enquiries.

Note from Publisher

Nevertheless, it is heartening to see that the Malaysian media and civil society organisations have collectively launched a campaign called “Maaf Zahir Batin Hari Hari” or known as #MZB365 to help heal a dividing Malaysia. Carrying the meaning of “please forgive my wrongs, both thoughts and deeds”, the campaign will run for one whole year. This initiative could not have come at a better time. We believe the majority of Malaysians still treasure the country’s unique social fabric. With #MZB365, hopefully the silent majority can have a bigger voice to counter the destructive noises of the divisive minority.

Announcement

Capital Dynamics Sdn Bhd and Capital Dynamics Asset Management Sdn Bhd, being capital market intermediaries licensed by the Securities Commission of Malaysia, are operating as usual in accordance with the Standard Operating Procedures prescribed by the relevant authorities. We will continue to take precautionary measures to protect our employees, clients and other stakeholders. You may reach us at +603-2070 2104 or 2105 or 2106 or email us at cdsb@icapital.biz (investment advisory) or enquiries@cdam.biz (asset management) for any enquiries.

Covid-19 SOP

All Capital Dynamics offices are operating as usual in accordance with the requirements/standard operating procedures ("SOP") as prescribed by the relevant authorities in their respective countries......MoreCovid-19 SOP

All Capital Dynamics offices are operating as usual in accordance with the requirements/standard operating procedures ("SOP") as prescribed by the relevant authorities in their respective countries.We will continue to take precautionary measures to protect our employees, clients and other stakeholders. All visitors must wear face masks and ensure social distancing when you visit any of our offices. To better manage your visits and avoid any inconvenience, you are advised to make an appointment with us before your visit via phone call or via email to the relevant offices. For more details, please access the webpage of the relevant offices.Less

Impersonation

Dear clients, followers and friends,

We would like to alert you to ongoing impersonation scams, with fraudsters posing as employees, financial advisors, representatives, agents and/or associates of the Capital Dynamics Group by using pseudonyms.....MoreImpersonation

Dear clients, followers and friends,

We would like to alert you to ongoing impersonation scams, with fraudsters posing as employees, financial advisors, representatives, agents and/or associates of the Capital Dynamics Group by using pseudonyms. There have also been instances where fraudsters impersonated Mr Tan Teng Boo (“Mr Tan”), the Managing Director and representative of Capital Dynamics Group which comprises Capital Dynamics Asset Management Sdn Bhd, Capital Dynamics Sdn Bhd, Capital Dynamics Global Pte Ltd, Capital Dynamics (S) Pte Ltd, Capital Dynamics Asset Management (HK) Pte Ltd, Capital Dynamics (Australia) Ltd and Capital Dynamics Investment Management and Advisory (Shanghai) Co Ltd.. These fraudsters / impersonators have created fake social media accounts / profiles and/or online applications to carry out their impersonation scams.

Based on information received to date, the modus operandi of the impersonation scams appears to be:

- The fraudsters would reach out to the public via SMS text messages, WhatsApp, Telegram, LINE or Facebook. They may claim to be financial advisors from the Capital Dynamics Group and present fake licences and/or certificates purportedly issued by financial regulators to advise on investments and/or carry out investment plans.

- At times, they may also claim to be Mr Tan by using fake Facebook / WhatsApp profiles and groups which display Mr Tan’s name and photos. The fake WhatsApp profile appears to be created using the mobile number +60111492189. There may be other fake WhatsApp profiles created by the fraudsters. These fake profiles are not managed by the Capital Dynamics Group and/or its employees including Mr Tan.

- By impersonating our employees and/or claiming to be financial advisors acting on behalf of Capital Dynamics Group, the fraudsters would deceive victims into opening “accounts” with certain “trading platforms”. The fraudsters would falsely claim that they would guide the victims to conduct trades with immediate gains, or that they were offering investment plans or training courses purportedly on behalf of the Capital Dynamics Group. Consequently, the victims were induced to transfer money or cryptocurrency to their “trading accounts”. Over time, the victims were not able to withdraw their money or cryptocurrency and the fraudsters became uncontactable.

We urge all of you to exercise caution and to conduct the necessary due diligence before making any investments. Kindly note that:

- We will never ask our clients to open accounts with trading platforms and to transfer money or cryptocurrency to these accounts. We are not affiliated or linked in any way to these illicit and unlicensed “trading platforms”.

- We do not offer investment advice, investment plans or training courses through agents.

- Any information on our fund management services (as well as our investment advice, opinion and events) is published only on our official websites, iCapital publications and/or official social media accounts. A list of our official channels may be found below.

- You should lodge police reports if you think that you may be a victim of scams.

- Please contact us if you have any doubts or uncertainties over any communications made to you by any person claiming to be an employee, officer, financial advisor, representative, agent and/or anyone claiming to be associated with the Capital Dynamics Group. The contact details of each of our offices may be found at this link: https://www.capitaldynamics.biz/en.

The scams were conducted without the knowledge, consent and authority of Capital Dynamics Group and our management. We as well as our Managing Director have lodged police reports in Kuala Lumpur and Singapore and have duly notified the authorities of these impersonations and scams.

More information on the impersonation scams may be found at: https://www.icapital.biz/public/general_announcements

Best wishes,

Capital Dynamics Group Less

Copyright © 2002 - Capital Dynamics Sdn Bhd (Co. No. 171744-U). All rights reserved.

i Capital ® and Capital Dynamics ® are registered trademarks of Capital Dynamics Sdn. Bhd.