Copyright © 2002 - Capital Dynamics Sdn Bhd (Co. No. 171744-U). All rights reserved.

i Capital ® and Capital Dynamics ® are registered trademarks of Capital Dynamics Sdn. Bhd.

-

MalaysiaMalaysia – Mar Vehicle SalesPublished on 24/04/2024 03:43:43 AM

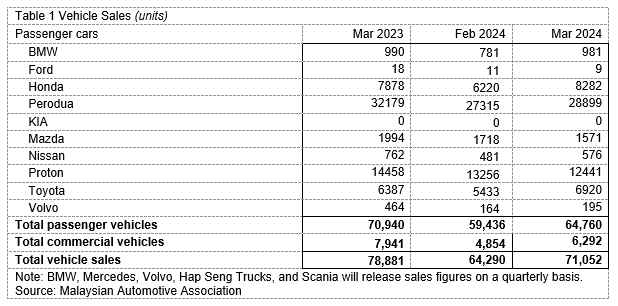

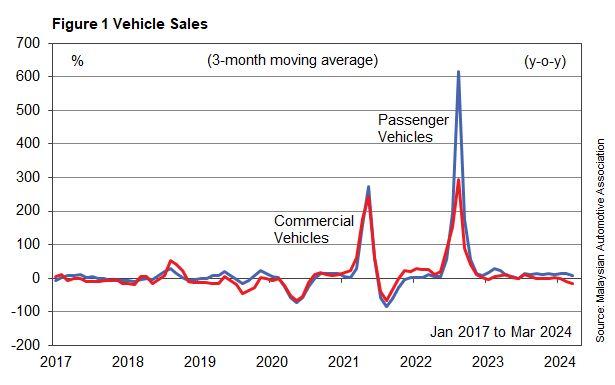

Total vehicle sales in Mar rose by 10.5% month-on-month to 71,052 units, of which passenger vehicle sales increased by 9.0% to 64,760 units, while commercial vehicle sales jumped by 29.6% to 6,292 units (table 1).

On a year-on-year basis, the three-month moving average of passenger vehicle sales expanded by 7.6%, while that of commercial vehicle sales contracted by 16.5% (figure 1).

-

Hong Kong EconomyHong Kong – Mar Consumer Price IndexPublished on 23/04/2024 10:26:23 AM

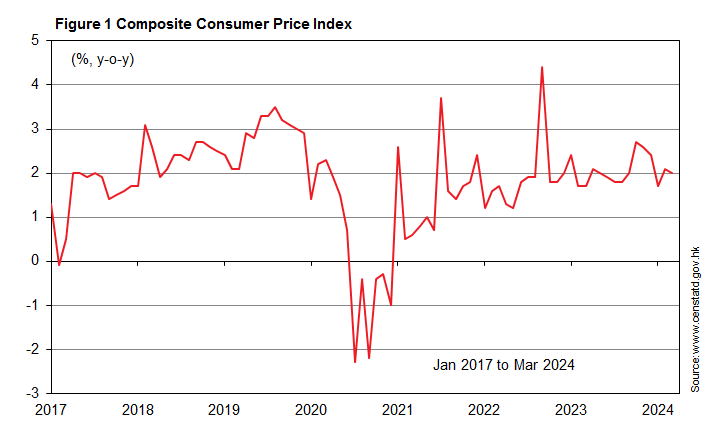

In Mar, the composite CPI rose by 2.0% year-on-year (figure 1). Netting out the effects of the government’s one-off relief measures, the underlying inflation rate was at 1.0% in Mar.

Overall, inflation should stay moderate in the near term.

-

USUS – Mar Durable Goods OrdersPublished on 25/04/2024 02:33:35 AM

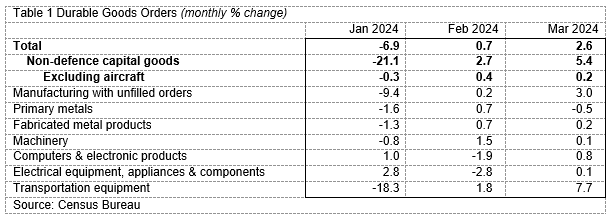

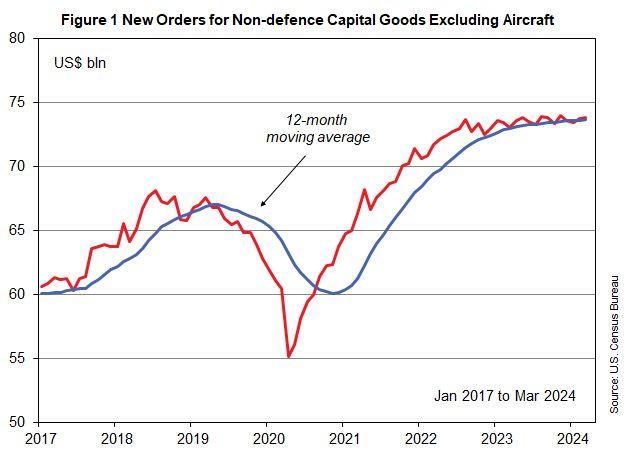

In Mar, new orders for durable goods increased by 2.6% month-on-month to a seasonally adjusted US$283.4 bln (table 1). New orders for non-defence capital goods excluding aircraft, an indication of business investment spending, increased by 0.2% month-on-month, slightly above its 12-month moving average (figure 1).

-

ChinaChina – Jan-Mar 2024 Household IncomePublished on 16/04/2024 03:56:36 AM

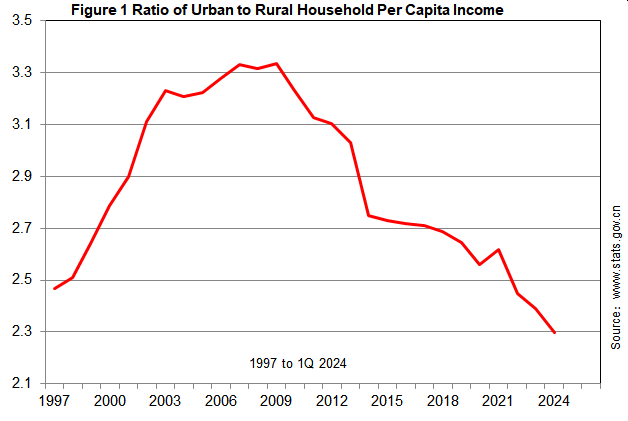

In Jan-Mar 2024, household disposable income per capita rose by 6.2% year-on-year to RMB11,539. Factoring out the price effects, household income also rose by 6.2%. Urban household disposable income per capita rose by 5.3% to RMB15,150, while the per capita cash income of rural households gained 7.6% to RMB6,596. In real terms, urban and rural household disposable income per capita rose by 5.3% and 7.7% respectively. Meanwhile, the ratio of urban to rural household per capita income continued to fall (figure 1). This bodes well for private consumption growth in 2024.

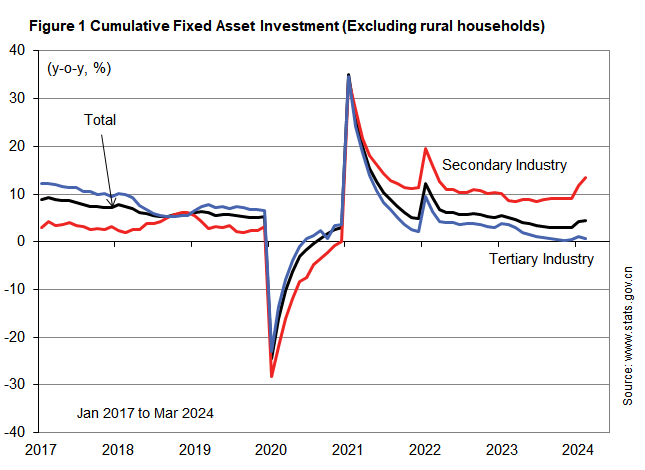

China – Jan-Mar Fixed Asset InvestmentPublished on 16/04/2024 03:25:36 AM

China – Jan-Mar Fixed Asset InvestmentPublished on 16/04/2024 03:25:36 AMIn Jan-Mar 2024, fixed asset investment (excluding rural households) rose by 4.5% year-on-year (figure 1), driven mainly by strong investment in manufacturing and infrastructure investment. Public investment expanded by 7.8%, while private investment edged up by 0.5%. Investments by state-owned enterprises continued to provide solid support to investment activity. Private sector investment is expected to recover later in 2024 when the economic recovery gathers momentum.

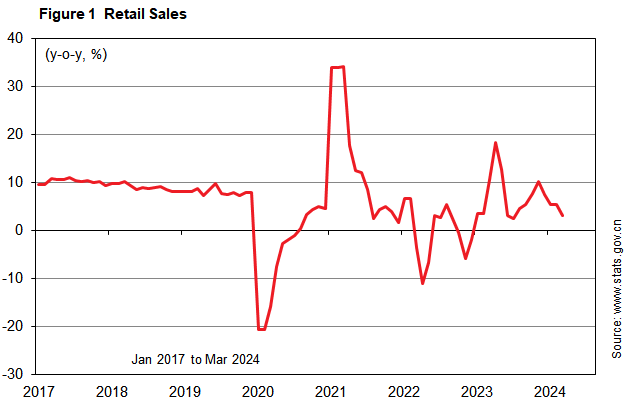

China – Mar Retail SalesPublished on 16/04/2024 03:10:23 AM

China – Mar Retail SalesPublished on 16/04/2024 03:10:23 AMRetail sales recorded a year-on-year growth of 3.1% in Mar, moderating from the growth rates in the past few months (figure 1). Excluding car sales, retail sales rose by 3.9% year-on-year. In Jan-Mar 2024, retail sales rose 4.7% from the corresponding period a year ago. Given the strong tourism data during the Qingming holidays, retail sales should post a stronger growth in Apr.

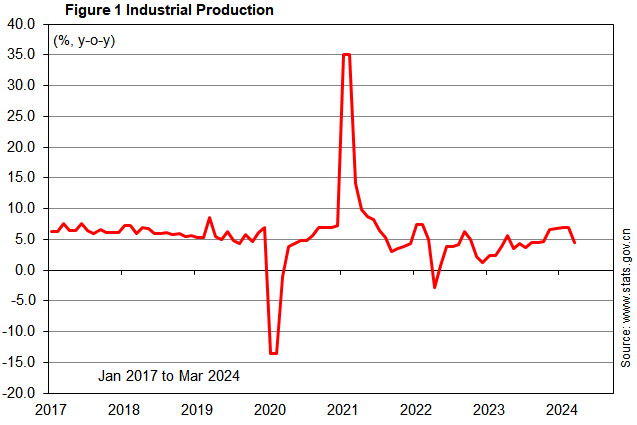

China – Mar Industrial ProductionPublished on 16/04/2024 02:55:33 AM

China – Mar Industrial ProductionPublished on 16/04/2024 02:55:33 AMIndustrial production rose 4.5% year-on-year in Mar (figure 1), slowing from the strong growth rates in the past few months. Manufacturing output rose by 5.1%, while mining output gained 0.2%. Out of the 41 major industries, 32 posted increases in output. In Jan-Mar 2024, industrial output rose 6.1% from the corresponding period a year ago. Given a stronger manufacturing PMI in Mar, industrial production should post a stronger growth in Apr.

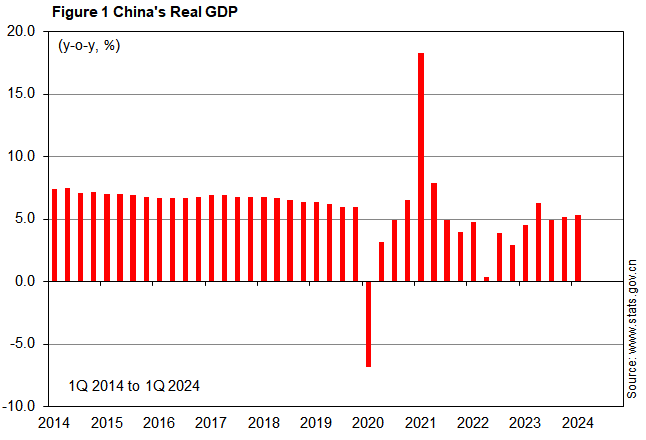

China – 1Q 2024 GDPPublished on 16/04/2024 02:33:41 AM

China – 1Q 2024 GDPPublished on 16/04/2024 02:33:41 AMIn 1Q 2024, China’s real GDP rose by 1.6% from the preceding quarter, and expanded 5.3% from a year ago (figure 1), well above analyst expectations of below 5% growth. Economic growth was powered mainly by strong manufacturing output, a steady services sector, and a recovering external demand. i Capital maintains its forecast that China’s real GDP will grow in the range of 5.0% - 6.0% in 2024.

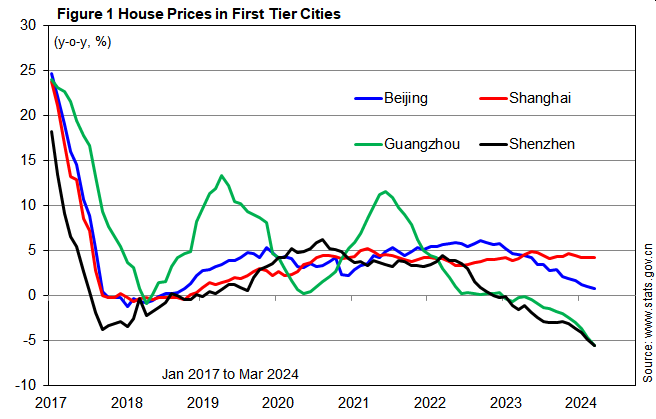

China – Mar House PricesPublished on 16/04/2024 02:04:09 AM

China – Mar House PricesPublished on 16/04/2024 02:04:09 AMIn Mar, house prices in the 4 first-tier cities fell by 0.1% month-on-month, and 1.5% year-on-year (figure 1). House prices in the 31 second-tier cities fell by 0.3% month-on-month, and 2.0% year-on-year, while those of the 35 third-tier cities fell by 0.4% month-on-month, and 3.4% year-on-year. As the Chinese government is allowing market forces to correct its property sector and not bailing out developers that are seriously insolvent, house prices are expected to stay weak in the short term.

-

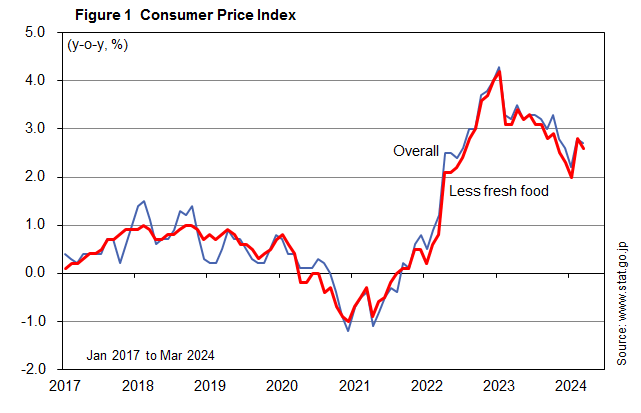

JapanJapan – Mar Consumer Price IndexPublished on 19/04/2024 01:27:20 AM

The consumer price index (CPI) increased 0.3% month-on-month and 2.7% year-on-year in Mar 2024. Excluding fresh food, the Bank of Japan’s inflation benchmark, the CPI rose by 0.3% month-on-month and 2.6% year-on-year (figure 1). The inflation rate has reached or surpassed the central bank’s 2% target for 24 consecutive months. After taking out fresh food and energy prices, the core CPI increased 0.2% month-on-month and 2.9% year-on-year. As workers have secured a strong wage hike in this year’s wage negotiation, inflation rate is expected to stay above the 2% target this year.

-

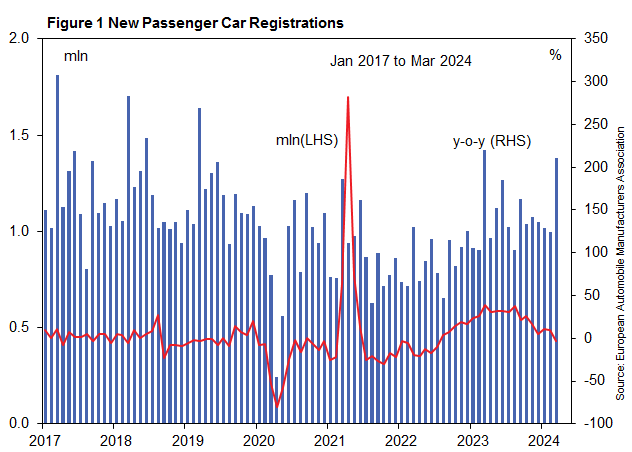

EuropeEurozone – Mar Car SalesPublished on 19/04/2024 12:40:50 AM

In Mar, new passenger car registrations in Europe decreased by 2.72% year-on-year to 1,383,410 units (figure 1). The different timing of the Easter holidays negatively impacted Mar’s sales across most EU markets, with the largest declines registered in Germany (‑6.2%), followed by Spain (-4.7%), Italy (-3.7%), and France (-1.5%).

-

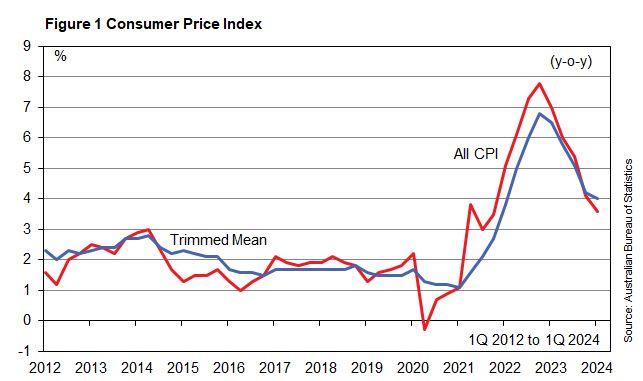

AustraliaAustralia – 1Q Consumer Price IndexPublished on 24/04/2024 06:15:01 AM

In 1Q 2024, the consumer price index (CPI) rose by 1.0% quarter-on-quarter.

Year-on-year, headline CPI increased by 3.6%, down from 4.1% in 4Q 2023. The inflation rate was mainly driven by price increases in the insurance and financial services (8.2%), alcohol and tobacco (6.3%), education (5.2%), housing (4.9%), and health (4.1%).

Meanwhile, the inflation rate as measured by the trimmed mean measure rose by 4.0% year-on-year (figure 1).

-

SingaporeSingapore – Mar Consumer Price IndexPublished on 23/04/2024 10:26:47 AM

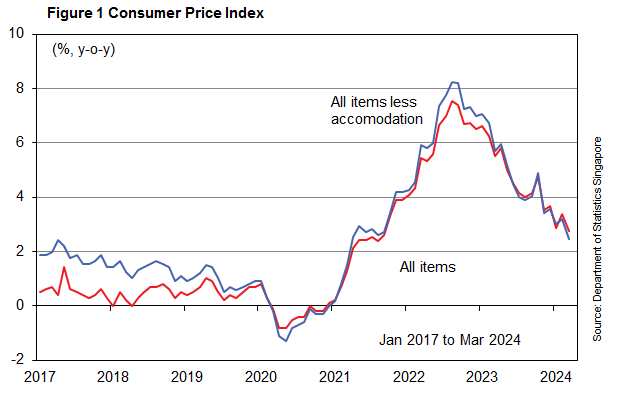

In Mar, the consumer price index (CPI) went down by 0.1% month-on-month, but up by 2.7% year-on-year (figure 1).

Month-on-month, the MAS core inflation, which excludes accommodation and private road transportation costs, fell by 0.2%. On a year-on-year basis, the core inflation rate was 3.1%.

The main contributors to the lower inflation rate were decreased costs of food, services and transport and communications.

-

SemiconductorsSemiconductors – Feb Semiconductor SalesPublished on 04/04/2024 01:16:30 AM

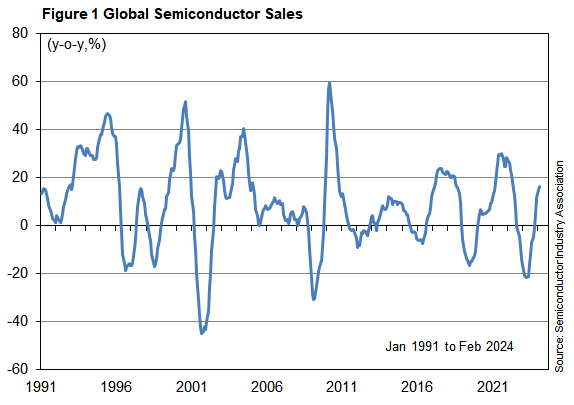

Global semiconductor sales in Feb fell by 3.1% month-on-month, the second consecutive month of decline. On a year-on-year basis, sales jumped by 16.3% to US$46.17 bln, the fourth consecutive year-on-year increase (figure 1), driven by strong demand in Americas and China.