22/11/2025 09:11 am MYT

By any standards, the annual Investor Day of icapital.biz Bhd is a massive event. This year's is made even larger by having the Budding Value Investor Award as part of the investor Day and then having a track 2 for Day 2 of Asia's most innovative event. Wow, not only is the event large, it is incredibly complex. Just the logistics of handling so many speakers and the university students is already nightmarish. On top of that, the entire 2-day event, including the planning and marketing of Investor Day, was internally managed by Capital Dynamics. To make the whole matter even more mind-boggling, Capital Dynamics does not have a huge workforce. To deal with possible disruptions from the two London vultures of ICAP, the 2025 AGM was held separately, unlike previous years. In the 2024 AGM, the London vultures filed a last minute injunction to postpone the said AGM (this matter is now at the Appeal Court level, with the London vultures having lost at the High Court level).

The planning of the 2025 Investor Day actually started way back in 2024, soon after the Investor Day for that year was completed. Even though the 2025 event has barely ended, the planning for the 2026 Investor Day will be starting soon. Looking for suitable venues nowadays is getting to be more difficult. So, in the run up to 15th and 16th November, it has been very exhausting on our side, especially for the smallish core team at Capital Dynamics led by Tan Teng Boo. In addition, the 2025 i Capital Talent Show is being held in just two days' time, on Saturday, 22nd Nov at Sunway University. Admission is free for everyone and details can be found at https://events.icapital.biz/. As a result, this week's KLSE Conclusion article will be uncharacteristically short.

Note from Publisher

It was recently reported that internal company documents of Meta projected it would earn about US$16 bln, equivalent to 10% of its overall annual revenue, from running advertisements for scams and banned goods. The company's platforms were involved in a third of all successful scams in the US. In fact, Meta's own research suggests that its products have become a pillar of the global fraud economy. A weak regulatory environment does not require the social-media giant to make greater efforts to protect its users from being exposed to fraudulent e-commerce and investment schemes, or the sale of banned medical products. The US government has forgotten that contents of social media are borderless. If the US government chooses to ignore or allow the illegal and irresponsible behaviour of her own social media giants, the rest of the world gets adversely affected. The Chinese government was smart and responsible enough to impose controls on such double-edge social media.

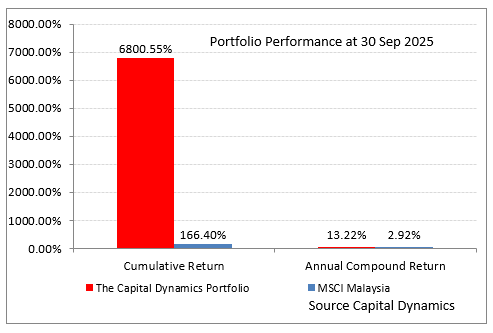

Capital Dynamics is licensed in a number of countries to conduct its investment advisory and fund management activities. Compliance with the various rules and regulations of these countries is a major exercise. However, stringent regulations in the financial industry are necessary because it involves the ordinary people and their hard-earned money. In addition, a properly regulated financial system is indispensable for savers and investors to have the confidence to place their money in the markets and support economic activities. When investors purchase the products and services of Capital Dynamics, they can rest assure that they are dealing with a financial institution that makes protecting investors’ interests its key mission and we operate in a tightly regulated environment.

PORTFOLIOS

CORE VALUES

In The Media

STOCK SELECTIONS

KLSE | 1 day, 3 hours ago

HKEX | 1 week, 5 days ago

KLSE | 2 weeks, 1 day ago

HKEX | 2 weeks, 5 days ago

KLSE | 3 weeks, 1 day ago

Corporate News