25/10/2025 08:40 am MYT

Thanks to the Trump-led shutdown of the US government, the Sep consumer price index (CPI) report which was supposed to have been released on 15 Oct has been delayed to 24 Oct. A surprising feature of Trump's tariff imperialism has been their so far subdued impact on US consumer prices. Observers and analysts have attributed this to a few reasons (like pauses between tariff announcement and enactment, which allowed many firms to build their inventories), i Capital has pointed out in its recent issue that Trump 2.0 has been intentionally rolling his tariff stage by stage, sector by sector, negotiation by negotiation. One reason for this Plan B was to ensure that the NYSE and NASDAQ do not crash and the impact of his tariffs on US inflation can be managed. So, the 24 Oct CPI report will be helpful to answer the question on whether inflationary fears from Trump's tariffs are overblown. As we wait, it is useful to examine cost and price expectations from the Atlanta Fed's Business Inflation Expectations (BIE) survey and The CFO Survey (a quarterly survey of CFOs that the Atlanta Fed conducts in partnership with the Richmond Fed and Duke University).

Around two-thirds of respondents to these surveys were firms that imported at least some portion of their inputs/supplies from abroad, while the rest of the firms sourced all their inputs domestically. The authors of the analysis, Kevin Foster, Ty McClure, Brent Meyer, and Daniel Weitz compared these two groups to see if importing firms, which are more exposed to tariff, expect meaningfully different outcomes for their business.

Note from Publisher

Recently, a series of gruesome crimes that took place in schools has shocked the Malaysian public. Given the severity of these violent acts, it would not be an exaggeration to suggest that if Malaysia allowed the possession of firearms, the kind of mass shootings frequently seen in US schools could very well occur here. The mere thought of such a possibility sends chills down the spine. Malaysia need not go that far. The Malaysian government and society should re-look at the abusive use of smart phones and access to social media. Malaysia need only look at how the Chinese government has tackled such situations.

These tragedies have sparked widespread discussion and debate across the media. Many have shared their views on why young people could commit such horrific acts at such an early age — what has gone wrong with our education system, our family values, and, more importantly, what steps should be taken to prevent such tragedies from recurring. There is no single solution to this complex issue. Every segment of society — parents, teachers, the media, religious bodies, and the government — has a role to play in instilling and nurturing the right values and behaviour among our youth.

Each year, Capital Dynamics and icapital.biz Berhad jointly organise two events dedicated to young people — the Budding Value Investor Award and the i Capital Talent Show. These initiatives provide excellent platforms for parents and teachers to strengthen their bonds with their children and students as they work together to prepare for the competitions.

The Budding Value Investor Award will see the finals presented on Saturday, 15th Nov and the i Capital Talent Show on Saturday, 22nd Nov 2025.

For more details on the Budding Value Investor Award, go to bvia.icapital.biz and go to events.icapital.biz for the 2025 Talent Show.

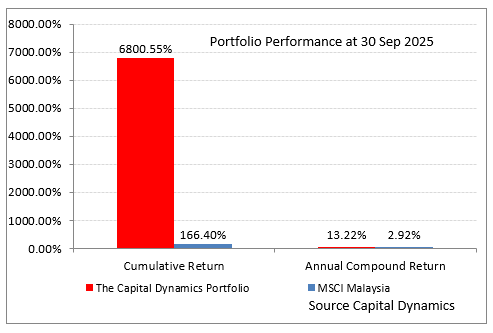

PORTFOLIOS

CORE VALUES

In The Media

STOCK SELECTIONS

KLSE | 1 day, 5 hours ago

HKEX | 5 days, 16 hours ago

INNOSCIENCE (SUZHOU) TECHNOLOGY HOLDING CO., LTD (INNOSCIENCE, 02577)

KLSE | 1 week, 1 day ago

HKEX | 1 week, 5 days ago

KLSE | 2 weeks, 1 day ago

Corporate News

3Q results

2Q results

3Q results

3Q Results

Supplemental agreement