16/05/2025 06:47 pm MYT

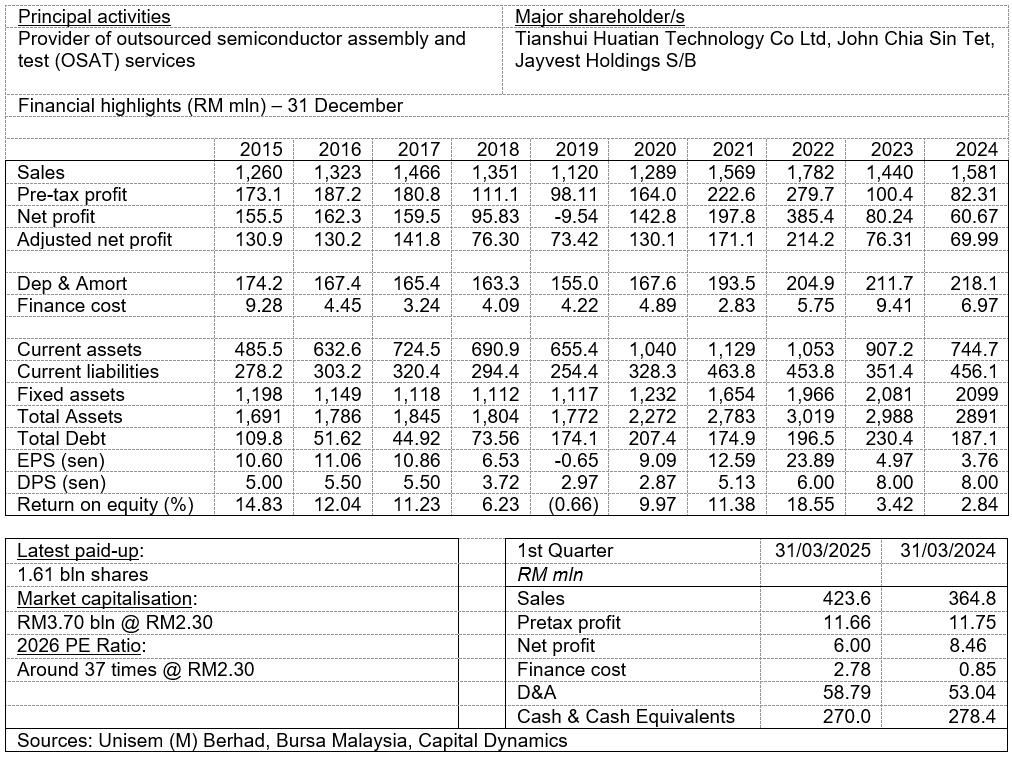

This week, i Capital updates on Unisem (M) Berhad (Unisem). Unisem is an outsourced semiconductor assembly and test (OSAT) provider listed on Bursa Malaysia. As an OSAT, Unisem offers turnkey semiconductor assembly and test services including wafer probe, wafer backgrinding, wafer bumping, assembly, test, and drop-shipping of finished goods to customers’ designated locations.

Doubling of production capacity

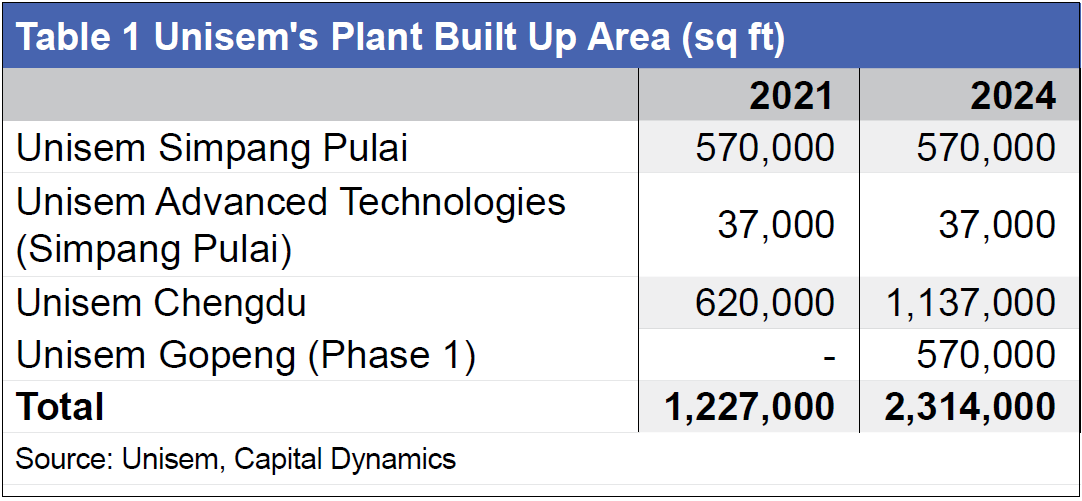

Unisem operates 4 facilities: two in Ipoh, one in Chengdu, and a newly opened one in Gopeng. The two new facilities in Gopeng and Chengdu have doubled Unisem’s production capacity in their aiming to improve efficiencies and better serve customer needs (table 1).

The new Phase 3 plant in Chengdu, which is equipped with cleanroom facilities spanning approximately 25,344 square meters, began contributing revenue in FY2024 with utilisation expected to increase in FY2025. Phase 1 of Unisem’s Gopeng plant recently kicked off production after completing customer qualification and equipment set-up.

The new plant in Gopeng will focus on the leadless and substrate packages i.e. QFN, DFN, MIS, LGA, BGA, and SIP. Meanwhile, leaded and legacy packages, along with WLCSP (Wafer-Level Chip Scale Packaging) and certain flip-chip QFN packages (primarily post-bumping processes), will continue to be manufactured at Uni

Note from Publisher

At the end of 2024, there were 38.7 mln registered vehicles in Malaysia. In comparison, Malaysia’s population stood at just 34.1 mln. No wonder traffic congestion is a serious problem not just in the Klang Valley, but all over the country. A major reason why Malaysia has so many cars is due to its weak public transport system, causing people to shy away from them. The public transport usage rate in Malaysia is a low 25%. The comparative usage rates in Singapore, Seoul, and Tokyo are 67%, 63%, and 73% respectively.

Expanding domestic connectivity networks, increasing the frequency of trips, speed of transport and their reliability are among the urgent tasks the Ministry of Transportation needs to address to bring up the country’s public transport usage rate. i Capital has written many times that traffic congestion has cost the Malaysian economy dearly and urged the Malaysian government to focus on building railway networks to connect all major cities and towns within Malaysia.

Tan Teng Boo has even repeatedly asked the Malaysian government to abandon the KL-Singapore high-speed rail project and to instead urgently focus on connectivity with Malaysia. If his sound advice is implemented, Malaysia’s public transport usage rate will surely catch up with that of Singapore, Seoul, and Tokyo. The entire Malaysian economy will benefit as a result. Balik kampung, going for trips during school holidays and rushing back for Chinese New Year reunion dinners need not be such a torture.

PORTFOLIOS

CORE VALUES

In The Media

STOCK SELECTIONS

KLSE | 6 hours, 3 home.stockSelection.minutes ago

HKEX | 4 days, 16 hours ago

C&D INTERNATIONAL INVESTMENT GROUP LIMITED (C&D INTL, 01908)

KLSE | 1 week ago

HKEX | 2 weeks, 4 days ago

KLSE | 3 weeks ago

Corporate News

FY Results

Project Management Engagement

1Q results

Memorandum of Understanding with Oriental Holdings Berhad

Memorandum of Understanding with LBS Bina Group Berhad